Putting your money into Bitcoin, altcoins, stablecoins, and other digital assets comes with plenty of financial risks. Witness the most recent crypto crash during the second quarter of 2022, when Bitcoin alone lost 58% of its value As Bloomberg.com framed it, crypto markets sustained a $2 trillion freefall. And it has been a bumpy ride for crypto investors ever since.

We don’t advise anyone to jump into crypto markets before they understand what cryptocurrencies are and how blockchains—the technology behind crypto—work. Investors should have a defined strategy before committing funds to the crypto market. Know how much you can afford to invest. Set reasonable ROI goals. Figure out how long you intend to stay invested. And decide whether you’re going to take the time to become a knowledgeable day trader or whether you expect to be a more passive trader.

And most importantly, investors should know how to protect themselves from needless risk by adopting crypto-safe habits. Let’s take a look at some best safety practices when it comes to crypto investing. Crypto markets are volatile enough! Don’t subject yourself to more risk than is absolutely necessary.

Private and Corporate Investors Face Similar Risks

It doesn’t matter whether you’ve invested hundreds or hundreds of thousands of dollars in crypto. Our best safety practice tips are designed to protect individual and institutional investors alike. It comes down to scale. Institutional investors may have more on the line in pure dollars. But even a few hundred dollars may comprise a large investment for you. So protect every dollar you invest as if it were a million dollars by following these common sense tips.

Safety Tip #1

How much do you know about cybersecurity and what measures do you already take to protect yourself when transacting business online? Once you jump into crypto investing, those measures become all the more important. We’re not talking about buying a set of cheap wine glasses on Amazon.com. We might be talking about your retirement savings, though—something you probably don’t want to gamble with. Before transacting any crypto business, it’s time to take a personal inventory of your online habits.

Safety Tip #2: Clean up Your Password Act

The time to get sloppy with passwords—if there ever is one—is definitely not when you start investing in digital currencies. Need a refresher course on good password hygiene? Here it is in a nutshell.

- Create strong passwords that don’t include numbers and words that relate to public information on you. No street names. No pet names. No former phone numbers.

- Do not duplicate passwords across multiple accounts.

- Change your passwords frequently.

- Don’t carry a physical list of your passwords.

- Don’t share passwords with anyone.

The average consumer has about 100 passwords. That’s a lot to manage. That’s why, when you start investing in cryptocurrency, you might want to also invest in a password manager. Some of the best password managers cost less than $5 a month. They do the hard work for you by creating strong passwords and updating your passwords regularly, automatically. And you only have to remember one password while you’re using a password manager.

Safety Tip #3: Avoid Public Wi-Fi Networks.

Have laptop, will do business—anytime, anywhere. That’s a motto many of us have adopted. We’re accustomed to banking while enjoying breakfast at a favorite diner or during an airport layover. Stop that! You have no idea whether those public networks are properly protected against cyber crooks. Instead, set yourself up on a Virtual Private Network (VPN). The cost is minimal or even free.

Safety Tip #4: Choose the Right Crypto Wallet

Once you’ve bought some cryptocurrency, your purchase is recorded across dozens or even hundreds of servers around the world. Those servers amount to a blockchain. Blockchains make financial transactions more secure, due to the redundancy that’s built into them. But when you need to access your crypto, whether to execute a trade or spend it on a Subway sandwich, you need a crypto wallet. There are several kinds of crypto wallets but they all perform the same function: they store the private keys you need to move crypto. Yes, trading crypto involves more passwords—and very sensitive ones, at that.

Crypto wallets can be custodial or non-custodial. The crypto exchange where you purchase crypto may offer to store your private keys for you. That’s known as a custodial wallet. Custodial wallets aren’t considered the safest wallets because crypto exchanges are more subject to massive data breaches. That isn’t to say that millions of people don’t use them. But most experienced crypto owners choose non-custodial wallets: wallets they control themselves.

There are two main types of non-custodial crypto wallets: hot (also known as soft) wallets and cold (also known as hard) wallets. The difference is that hot wallets are connected to the internet. The information in a cold wallet is stored offline in a small electronic device. Each type of wallet has enthusiasts and detractors. In truth, you may want to have both kinds of wallets. Here’s why.

Cold wallets are generally considered safer than hot wallets because they’re not subject to online hacking. But they’re not very convenient if you want to spend your crypto, say, on a Frappuccino at Starbucks. For a cold wallet to work, it needs to be plugged into a computer. But Starbucks will let you pay for your drink directly from a hot wallet. Similarly, if you are a crypto day trader—perhaps you make dozens of crypto transactions a day, you can transact business from anywhere there’s a Wi-Fi connection with a hot wallet.

Most crypto owners find that using a two-wallet strategy gives them both the safety and the convenience they need. They keep the majority of their crypto assets in a cold wallet and transfer them to a hot wallet as they need them.

Safety Tip #5: Stay Clear of Scammers

Hoodwinked. Bamboozled. Fleeced. Ripped off. The words we use to describe them have changed over the centuries, but scams have been around since the dawn of time. What makes crypto scams so scary is that, due to electronic communications, they can be launched on a massive scale. The Federal Trade Commission reports that more than 46,000 people have reported losing over $1 billion in crypto to scams since the beginning of 2021.

Crypto scams come in all different shapes and sizes, but you should familiarize yourself with the most common scam signals:

- If it sounds too good to be true, it’s likely false. Scammers make outrageous get-rich-quick claims and contact you incessantly with their phony offers.

- Phishing scams aim to steal the information required to access your crypto holdings: your private keys. You may receive an email that appears to be from a trusted source. It will include a link to a fake website where you will be asked for your private key. Once a scammer has your private key, your crypto holdings are no longer safe and can be stolen in minutes.

- Crypto scammers haunt online dating sites. So-called “romance scams” are common now. Scammers lull victims into trusting them by creating a false sense of intimacy. Soon the talk turns to cryptocurrency and the opportunity to invest in crypto presents itself. A would-be love interest might suggest you invest in crypto together and share a private key. Beware of any “match” that asks you for currency in any form. Never share your private keys with anyone, let alone someone whose true identity isn’t known to you.

- Remember that nothing must be paid for in cryptocurrency. Crypto mortgages may be an exception to that rule, but generally, if a company demands crypto in exchange for merchandise or services, promptly decline to participate in the transaction.

- Be especially careful when you use social media platforms. Again, according to the FTC, “Nearly half the people who reported losing crypto to a scam since 2021 said it started with an ad, post, or message on a social media platform. Of those who specified the platform where the scam began, 32% said it was on Instagram, 26% said Facebook, 9% said WhatsApp, and 7% said Telegram.”

Top Safety Takeaways

- Practice perfect password hygiene

- Don’t let crypto exchanges store your crypto for you. Invest in your own crypto wallet. A combination of cold and hot wallets may be the safest way to go.

- Avoid public Wi-Fi networks. Use a personal VPN instead.

- Crypto investments are volatile. Never invest more in crypto than you can afford to lose.

- Learn to recognize the common features of crypto scams.

Crypto has minted many millionaires, for certain. But many fortunes have been lost in the crypto markets, too. Educate yourself before you decide to put your money in crypto. We encourage you to start small and continue to expand your crypto knowledge base by consulting authoritative resources who have no financial interest in your investments.

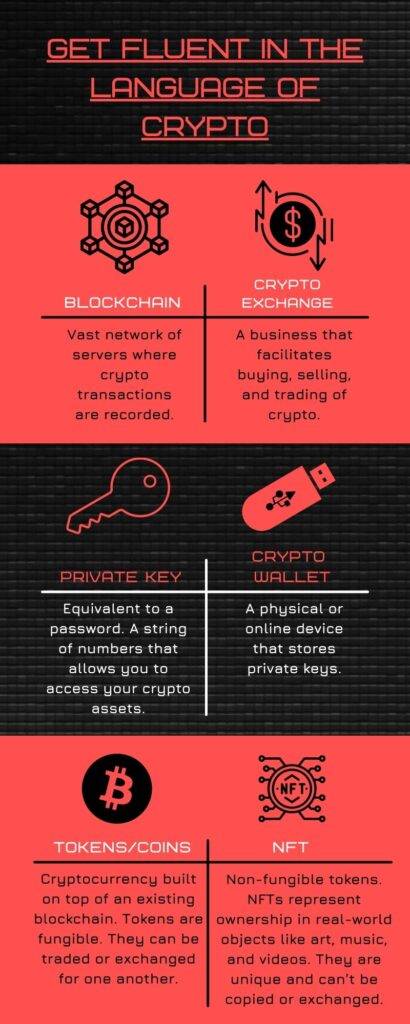

Infographic:

Get Fluent in the Language of Crypto

| Blockchain | Vast network of servers where crypto transactions are recorded |

| Crypto Exchange | A business that facilitates buying, selling, and trading of crypto |

| Private key | Equivalent to a password. A string of numbers that allows you to access your crypto assets. |

| Crypto Wallet | A physical or online device that stores private keys |

| Tokens/Coins | Cryptocurrency built on top of an existing blockchain. Tokens are fungible. They can be traded or exchanged for one another. |

| NFTs | Non-fungible tokens. NFTs represent ownership in real-world objects like art, music, and videos. They are unique and can’t be copied or exchanged. |

Read more: 6 Apps to Get You Started on Crypto