Last Updated on July 16, 2024 by Team Experts

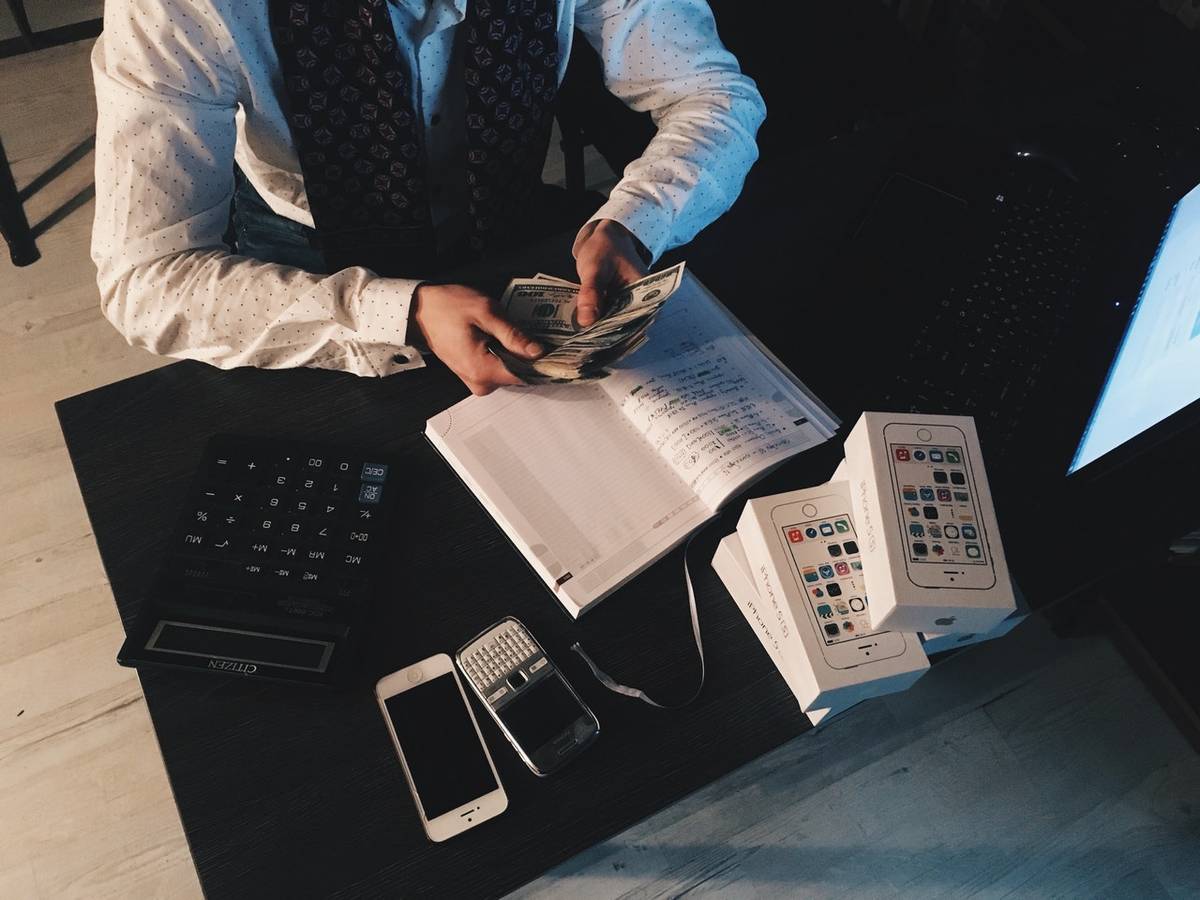

Bookkeepers are professionals who are experts in collecting and maintaining financial records for a company in-house or for clients. Traditionally, bookkeepers dealt with a humungous amount of papers and documents. The risk factor in a traditional setup used to be considerably high – losing and misplacing documents is always a possibility, accidents like fire breakouts are also a probability as is the risk of documents getting destroyed by bugs. Moreover, carrying documents would mean lugging fat files of papers. However, with digital documents becoming a reality, online or virtual bookkeeping services have become a norm today. Virtual bookkeepers are using cloud servers to store files and documents that they can access from anywhere any time.

Online bookkeeping services need to be aware of security tips

- Going online is one of the most convenient moves for any kind of business. It promises better accessibility, sales, brand building etc. The bookkeeping business is not an exception. However, it is not necessarily without perils. Hacking is prevalent in the online world. Businesses have lost millions in such cyber-attacks. It is therefore essential for online bookkeeping services to get the virtual security walls up and strong. Cyber-attacks are usually carried out for money and ransom. Since bookkeeping is all about sensitive financial information, beefing up cyber security becomes mandatory.

- Offshore bookkeeping services mean that a bookkeeping business is being entrusted with crucial financial documents of a business based abroad. This will mean that the offshore bookkeeper might have to share details of some of the documents with the onshore team or the home office staff. It might seem like an ordinary situation but the exchange or sharing of documents can be intercepted by hackers. There is a high probability of such an accident, more so since these documents are related to financial facts and data. Hence, an offshore bookkeeping service should use a system that offers high-security.

3) Bookkeeping is not limited to keeping records. Many times financial transactions are also made by virtual bookkeeping services on behalf of their clients. It is obvious that as a bookkeeper the transaction records will be maintained by them. However, it never hurts to ensure that all the authorization signatures are in place.

4) As a job profile bookkeeping can singlehandedly provide all the documentation-related proofs as and when needed. In many legal cases, it is the only backup. Sharing documents when needed by the onshore teams also means sharing login credentials at times. Hence, virtual bookkeeping services should be using available and secure online tools that allow owners to change the login credentials immediately after the tasks are done.

5) One of the easiest ways to ensure that clients and offshore teams both have access to the bookkeeping files is to use web-based software. Nowadays, most of the files are saved on cloud-based servers that use cloud-based software. Web-based bookkeeping negates the need for single ownership of these files. The client and the online bookkeeping services can both have their log-in ids and credentials.

6) Last but not the least, virtual bookkeeping services must use a cloud-based bookkeeping management system. These systems have inbuilt classification apt for bookkeeping. They also enable customization of the system, allowing virtual bookkeepers to manage files according to their ease and convenience. One of the major advantages of using a cloud-based bookkeeping management system is that both the client and the bookkeeper are aware of the file location, format, chronology, divisions, subdivisions etc. Such a system also gives both parties the scope to discuss and decide the sections that are to be added or deleted or modified in the bookkeeping system. This ensures better streamlining of the bookkeeping process.

Bookkeeping deals with highly classified and sensitive financial information. Misplacing a document or losing a document to a wrong agent can result in blackmailing and financial losses along with putting an organization’s reputation at stake especially in the eyes of its stakeholders. With the mushrooming of virtual bookkeeping services, a lot of traditional bookkeeping risks are negated. However, new challenges of the virtual world are never far from a sensitive domain like bookkeeping. So virtual bookkeepers have to be alert and aware of the latest security and technology. Their virtual booking systems need to be upgraded as and when a better version comes into the market. This will ensure the highest security possible for the data that their clients entrust them with.