Last Updated on July 16, 2024 by Team Experts

Cryptocurrency has taken the world by storm of which everyone desires to get a lucrative chunk. Dazed by the profits many have earned and have thereby turned their fortunes; beginners often yearn to earn fast enough that they end up making mistakes. Mistakes that might make them never go back to Investing In Crypto.

But the good part is that people learn from mistakes as much as from success; probably more. These mistakes also serve as pearls of wisdom for others wanting to venture into the same space.

Crypto is lucrative but not without its share of high risk. To help you, here are some common crypto trading mistakes people make while investing. Learn from them and venture into the world of Crypto cautiously yet confidently.

1. Inadequate research

One may not be an expert in the Crypto market but adequate fundamental research about the market and its players is of utmost importance. It is imperative to understand basic aspects of Cryptocurrencies such as their market cap, price history, trading volume, fundamentals, management team, and its future outlook.

This is one of the most common mistakes enthusiasts make and do not research enough before making investment decisions. Many tend to pick a popular cryptocurrency and invest without knowing its fundamentals.

There are plenty of tools available which can help in fundamental research on any cryptocurrency.

2. Not identifying their investor profile

After deciding to invest, it is very common to not identify with one’s investor profile. In generic terms, the main profiles are that of ‘conservative’, ‘moderate’, or a ‘trader’.

A conservative also known as ‘Hodler’ exposes themselves to the minimum risk and their strategy is to hold on to an asset for a long-term appreciation.

A moderate investor has different positions in their portfolio with a variety of assets and follows the strategy of both a Hodler and a Trader.

Traders are the ones who make the most money in Crypto by benefitting from the fluctuations in short-term operations. They are also the ones that take the maximum risk.

To avoid losing money, it is advisable to strategize based on the investor profile one wishes to adopt.

3. Lack of a plan

Lack of a plan is surely inviting trouble. Although a beginner may not have an exact plan in place but with time, it is crucial to plan aspects such as investment goals, the amount of capital to invest in the trade and the maximum loss one is willing to take.

Working on whims and fancies without a concrete plan has spelled huge financial losses for many.

4. Undiversified Portfolio

As the adage goes, “putting all your eggs in one basket” may not be a good idea in Crypto investing as well. Many make this mistake and concentrate on only one type of investment rather than investing in multiple assets.

According to the findings of a survey in which respondents highlighted the biggest mistakes they made, 32.5% of respondents said that they had invested everything in a single coin.

This can lead to huge losses in case of events that disturb the financial market. The financial risk can be reduced by investing in different assets such as Bitcoins, Ethereum, Tether, and other altcoins.

5. Security issues

In any form of digital trading, another common and costly mistake is to take the security of digital assets lightly. In the year 2020 itself, crypto criminals stole as much as $1.9 billion.

Some of the strategies to reinforce the security of cryptocurrencies can be:

- Enabling 2FA (2 Factor Authorization) on every security-sensitive account

- Not leaving all coins on an exchange as it is a huge risk and invitation to hackers

- Owning a ‘hardware wallet’ which is a device disconnected from the internet, is a good idea if your investments in cryptocurrency are substantial. For someone to steal funds from a hardware wallet will mean stealing a physical device and also knowing the passphrase which is a daunting task.

6. Falling for Crypto scams

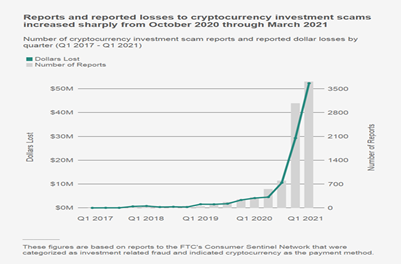

Crypto is the newfound love for scammers. Since October 2020, in the US alone, nearly 7000 people reported losses of more than $80 million on the scams around cryptocurrency.

Source: image

But there are ways to avoid falling for these scams:

- Be wary of people online who appear to be overly friendly and are willing to share tips

- Ensure the authenticity of websites that offer crypto investment opportunities. Many fake and scam sites use fake testimonials and crypto jargon to appear credible but are bogus

- ‘Giveaway Scams’ supposedly sponsored by celebrities promising to immediately multiply the cryptocurrency you send but are nothing then a scammer waiting to usurp your crypto. There have been reports of people sending over $2 million in the past six months in cryptocurrency to impersonators of Elon Musk!

- Online dating is the newest trick to draw people into crypto scams. A new long-distance relationship quickly turning into crypto opportunity chats and then pursuing to act upon the advice can very well be a scam and not love.

7. Overtrading and Revenge-Trading

A desire to earn too much too soon may lure an investor to overtrade; as many as 20 trades a day. This is dangerous as they may switch ideas too soon, not stick to their investment plan and lead to unnecessary losses. It also increases tax liabilities.

After incurring losses, many resort to Revenge Trading to make up for the lost money as fast as possible, without a concrete plan and most often resulting in losses again.

These are a few tips to prevent getting into this mode:

- Setting up a limit of maximum losses a day and week

- Sitting out for a fixed time after a losing trade

- Using stop-loss as a risk management practice

- Taking a break from investing for a couple of days after concurrent losses

8. Not understanding technology and the technicalities

Crypto is based on technology. While it is alright to not be very technologically strong, understanding the fundamentals is crucial. For a layman, technological jargons can sound intimidating at first but some amount of study will go a long way in making wise investment decisions.

Equally important is to be able to read the trading charts. The technical analysis of the trading charts will enable the investor to predict the future more soundly.

To conclude, mistakes are unavoidable but one can revisit them, learn from their own mistakes and those of others.

To make your Crypto journey worthwhile and avoid making the most common mistakes others have been making, we hope this article will be of help.

Read more: Significant Key Factors To Consider Before Trading On Cryptocurrency